Sevin Rosen have picked up some unfair stick (look at some of the comments here) about the way that they have cancelled their latest fund, preferring to hold out rather than participate in unprofitable investment opportunities currently doing the rounds.

Sevin Rosen have picked up some unfair stick (look at some of the comments here) about the way that they have cancelled their latest fund, preferring to hold out rather than participate in unprofitable investment opportunities currently doing the rounds.Whilst some cite it as the company losing its mojo, the also freely admit that the tech sector has become quite frothy, the seem to think that this can be avoided with smaller targeted fund investments. The problem is that there is a finite amount of good investment opportunities.

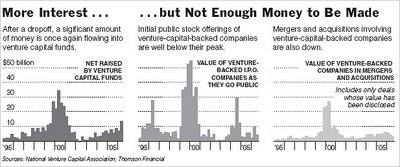

A lack of exit opportunities was also cited by the company as a key factor in their decision. There have been too many pension funds and their managers burned in the dot com and telecoms busts in the early noughties.

Graphic courtesy of the New York Times.